Post-Investment Approach

We will introduce our Post-Investment Approach.

Basic Principle

We believe that our mission is to contribute to business improvement/growth by providing the foundation for the sustainable development of portfolio companies during Aspirant Group’s investment period.

Members of Aspirant Group’s Operations team strive to enhance their skills and characters to support the management of the portfolio companies and to acquire the ability to improve their businesses.

However, the management and employees of the portfolio companies, who have been involved in the businesses for many years, actually have the deepest understanding of their businesses, and we believe that the key to solving the issues faced by our portfolio companies lies on the business frontlines.

Based on the Core Values, the members of Aspirant Group’s Operation team will contribute to the portfolio companies based on dialogue with the management and employees, never forgetting to “learn humbly from the management and employees of the portfolio companies” and to “work harder than anyone else and be creative in our contribution to the growth of the portfolio companies.

Framework for Post-Investment Activities

Throughout the investment period, Aspirant Group will work to improve and grow the business of portfolio companies based on the following four principles.

- Team Building: Gain mutual understanding and consensus with the management and employees of portfolio companies

- Numbers: Establish a system for understanding and visualizing key indicators and conduct timely/frequent monitoring

- Strategy: Clarify strategies to focus on and set common goals with portfolio company’s management and employees

- Quick Win: Sharing success stories from other companies with the portfolio company’s management and employees

The first is “Team Building.” We believe that teamwork based on relationships of trust with the management and employees of the portfolio companies is the foundation of subsequent business operations and is of the utmost importance. Next is “Numbers.” “Numbers” comes next because the basis of management decision-making is quantitative data. Based on these two premises, we believe it is possible to formulate and execute an effective “Strategy.” In order to promote these activities, we will work together with the management and employees of the portfolio companies to make improvements that will enable “Quick wins” as well as a long term success.

Organizational Structure of Involvement

Aspirant Group’s Operation team members will support the portfolio companies throughout the investment period.

100 Days Plan

During the first 3-6 months after the investment, based on dialogue with the management and employees of the portfolio company, we will develop a foundation for management/monitoring during the investment period and formulate a business plan that will become a common goal for the company and its employees. This initial approach is the “100 Days Plan.”

During the 100 Days Plan, a number of Aspirant Group’s Operation team members will be permanently/semi-permanently stationed at the portfolio companies to develop a foundation for subsequent improvement/growth.

Execution and monitoring of the plan

After the 100 Days Plan, the execution and monitoring phase of the business plan begins, in which the progress of the business plan established through the 100 Days Plan is monitored in a timely manner based on ongoing communication, and the plan will be revised as necessary.

In addition to cases where the existing management of the portfolio companies continues to handle the business operations after the 100 Days Plan, there are cases where the management is hired externally or Aspirant Group members are assigned. Depending on the situation of the management and the progress of the business plan, the degree of involvement of the Operations team members will be flexible.

Approach for Business Improvement/

Growth Support

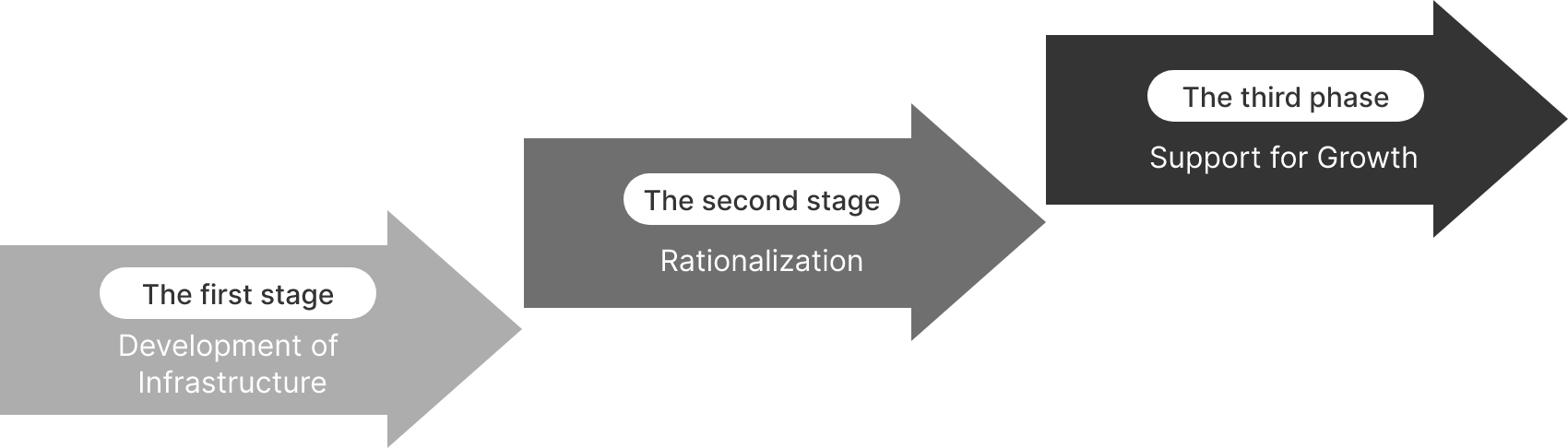

Aspirant Group’s approach to business improvement and growth support can be divided into three phases.

The first phase is to develop the infrastructure that will serve as the foundation for organized and efficient management. The second phase is to improve profitability and generate cash through implementing such measures, as concentration on profitable business segments as well as improvement of productivity improvement, and cash management. In the third phase, we will invest the capital that we have secured through the previous stages in the way of capital expenditure and for R&D in order to achieve sustainable growth.

The contents of these phases are as follows.

1st Phase Development of Infrastructure

We build a system that effectively functions for decision-making and information sharing based on “numbers.”

- 1. Development of an accounting management system

-

Create and implement a system for timely and accurate accounting and analysis necessary for decision making

- 2. Design/management of meeting structure

-

Establishment/operation of organizational management systems for timely information sharing and rapid decision making

- 3. Development of Corporate Infrastructure

-

Implement the following improvements

- Establish accounting, human resources, and general affairs functions as the basis for business operations

- Review of various regulations

- HR Education

- Ensure safety/quality

- Improve working environment/incentives

- ESG

2nd Phase Rationalization

Based on the analysis of detailed financial/non-financial information obtained in the previous section, we will improve profitability and secure funds for the growth.

- 1. Reallocation of Management Resources

-

Prioritize allocation of management resources to areas of growth and high profitability

- 2. Improvement in Productivity

-

Reduction of order loss

- Reducing lead time from production to delivery (Manufacturing industry)

- Purchasing activities/production control based on precise order forecasting (Manufacturing industry)

- Improving the accuracy of matching client staffing needs with temporary staff (Temporary staffing industry)

Cost reductions

- Increase in-house production rate/reduce outsourcing costs through variable staffing between departments according to busy/off-peak times (Manufacturing/service industry)

- Reduction of procurement costs through selection and consolidation of suppliers/thorough implementation of competitive quotations (Manufacturing/service industry)

- Automation of work by introducing manufacturing equipment/review and standardization of business processes/reduction of manufacturing costs through yield improvement (Manufacturing industry)

- 3. Pricing Strategy

-

Appropriate pricing and order decisions through cross-functional sharing of numbers between departments (typically between sales and manufacturing departments)

- 4. Improvement in Cash Management

-

Implement the following measures to secure funds.

- Shortening of collection sites

- Lengthening of payment sites

- Reduction of inventory (Control of material purchases, reduction of lead time from manufacturing to shipping, etc.)

3rd Phase Support for Growth

We will invest the funds obtained above in order to expand sales and achieve sustainable growth.

- 1. Sales Support/Sales Channel Expansion, etc.

-

Sales Support

- Enhance sales tools

- Reinforcement of organizational sales (Building a cooperative system among design/engineering/manufacturing departments, etc.)

- Reinforcement of sales management (Action management based on numbers, sharing of information, etc.)

Sales Channel Expansion

- Client referrals through Aspirant Group’s network

- Collaboration among portfolio companies

- Support for development of new clients/overseas markets, etc.

Others

- Support for the transformation of the profit structure, including expansion of stable income by strengthening the maintenance/after-sales service business and expansion into new businesses by utilizing existing resources

- 2. R&D/Capital Investment

-

Supporting the promotion of growth by redirecting capital and resources to areas that have potential but have not been provided with sufficient R&D and capital investment/resources for growth

- 3. Add-On Acquisition

-

If add-on acquisitions are an effective factor in the company’s growth strategy, provide support for target candidate selection/approach, negotiation, acquisition execution, and post-acquisition integration process